The ESG conversation has centered on the more easily quantifiable Environmental and Governance aspects. The greater ambiguity around the segments that make up the Social element makes it more challenging to quantify. Understanding the drivers and likely measurement techniques will help cut through some of the fog. As this space evolves, institutions that comply with Social policies will rise to the top.

The Social and Business Intersection

Business and social interests intersect where social responsibility wrestles with profitability-generating levers. These social responsibilities are now more closely aligned than ever with numerous movements over the past decade, and institutions’ relationships with their internal and external stakeholders are under the microscope as firms seek to cultivate the marketplace in which they operate for a more prosperous and brighter future given positive actions for the well-being of said institutions.

We will refer to “companies” within this article, but this will reference instruments issued by corporations, financial institutions, and governments and the investment vehicles that make up investors’ portfolios.

Social Segments

It can be far too easy to get lost in the specificities of social responsibility compliance, but we can try to break these down into Social segments to understand the minutia better:

- Human rights record and policies

- Human capital policies and procedures

- Employee working conditions and environment

- Firmwide diversity and equal opportunities

- Employee attraction and retention records

- Customer satisfaction records

- Product “mis-selling” safeguards

- Product safety and liability

Social Evaluation

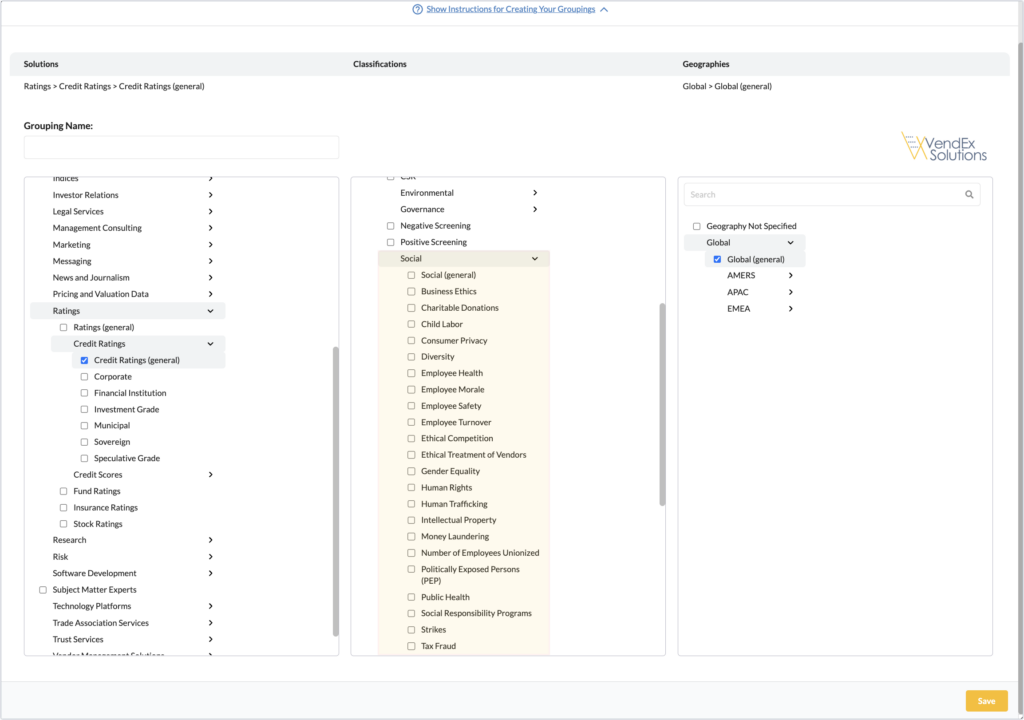

To understand these segments at a micro level, we must consider the array of market data services. The extract below from VendEx’s market data services directory details the sub-categories within ESG/Social within which data and analytics services can tag themselves to create more accurate and relevant search results when buyers evaluate data services. As more and more data vendors signal that they have a positive match of services that meet these categories and sub-categories, this will, in turn, create a best-in-class Social information repository. In the interim, companies are relying on less conventional tactics for insights into Social compliance.

Key Social Segments

There are a number of other categories that have come to the forefront in analyses, including policies around flexible working, misuse of personal information by employers, diversity of management boards, and the ratios of male/female across organizations. From the risk management perspective of investors, these categories are all as important as race, disability, age, and sexual orientation. These have been amplified over the past few years due to numerous events, including Black Lives Matter, the MeToo movement, COVID remote working, and the current cost of living crisis. Reputational risk has also been demonstrated recently with corporations pulling out of Russia, for example, given the backdrop of the Ukrainian invasion and potential reputational ramifications for continuing to service the domestic Russian market, indirectly fueling the escalation.

Benefits of Conforming

There are direct and indirect benefits to conformance with Social criteria since it will highlight more favorable benchmarking and scoring by vendors, and issuers will also ultimately manifest themselves into investors’ portfolios through the creation of “Social equity.” This is the theory, but in practice, accurate measurement is fundamental to showcasing these herculean efforts by institutions. Access to centralized and good-quality data in this respect is lackluster: what measures can be taken in the interim as the sector continues to build momentum?

Monitoring Social Equity

There are two well-known avenues that splinter down several routes: traditional vendors and alternative data vendors. Traditional data vendors can collect data from public domain disclosures or report data from privately held companies by collecting information at the source. They rely on corporate reporting disclosures that can either be subject to audit or taken in the spirit of honesty and transparency. Furthermore, traditional data vendors can create benchmarking or proxies using peer analyses or other third-party integration to augment their data into a full-scale offering, which may fulfill a reporting requirement.

Alternative data vendors are far more likely to be able to quantify key Social aspects, given their sheer scope and positive correlation to social reporting requirements. For instance, the degree of benchmarking can extend to key known variables like Value chain risk analyses, including vendors, suppliers, and KYC. Other examples include complaints data per sector, AML (Anti Money Laundering) checks, disclosure around policy for fair pay and pensions, and sector-specific reporting like the US Strengthening American Cybersecurity Act (reporting cyber issues). It is not the availability of this information that is in question, it is how to decipher this information or “noise.” For instance, there are well-oiled audience profiling platforms active in the marketplace that can efficiently run targeted questionnaires to certain demographics in society to generate a statistically independent cohort of results. Finally, there are web scraping algorithms that “goal seek” from reviews on professional or social media outlets.

For example, the Risk Intelligence startup AYLIEN aggregates and analyzes large quantities of news articles in order to identify Social risk indicators. Its clients are banks, insurance companies, and asset management firms, and what these clients typically have in common is their appetite for scoring a large number of entities–third parties, competitors, and indeed also themselves–based on the volume and the sentiment of unstructured data such as news articles published about them.

“News articles, blog posts, and social media updates are great reflections of the public zeitgeist,” said Parsa Ghaffari, CEO and founder at AYLIEN. “By capturing this data in unstructured form (i.e., text) and applying Natural Language Processing and Machine Learning techniques to it, we can distill a real-time and reliable stream of indicators for how well an organization or an entire industry is doing with regards to Social concerns such as gender equality, conscious capitalism, or the narrative around a sector such as banking in general.”

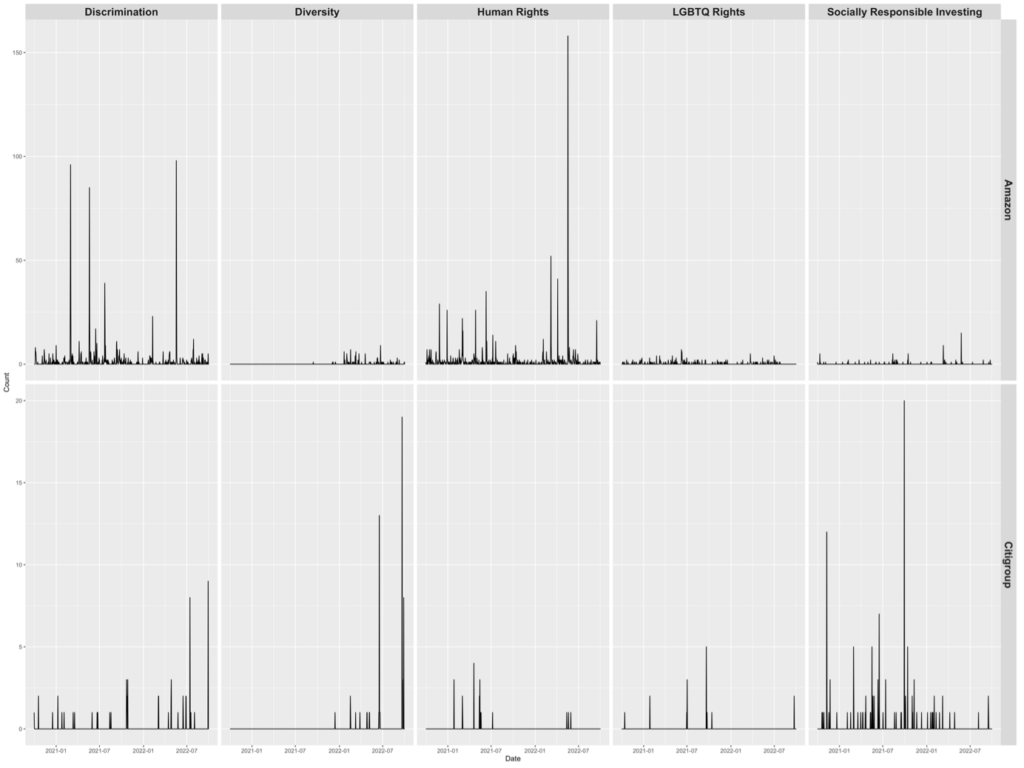

For example, in the chart above, we can see the volume of news articles published globally about Amazon and Citigroup. What makes this chart interesting is that using the power of Natural Language Processing, these articles have been automatically classified according to Social factors such as Discrimination, Diversity, Human Rights, LGBTQ Rights, and Socially Responsible Investing.

Data insights such as these are extremely valuable for tracking and quantifying an organization’s public perception. While the elements of Social evaluation are now widely known and understood, it is indeed the inability of market data services to perfectly penetrate these walls that creates a huge obstacle. However, the use of imperfect, unconventional, alternative, and audience-profiling technologies happens to bridge us with valuable insight into the many segments of Social assessment. At the same time, Social taxonomies continue their integration into reporting standards for public companies, and they begin their genesis within private companies’ disclosures for the most accurate synopsis of Social evaluation.