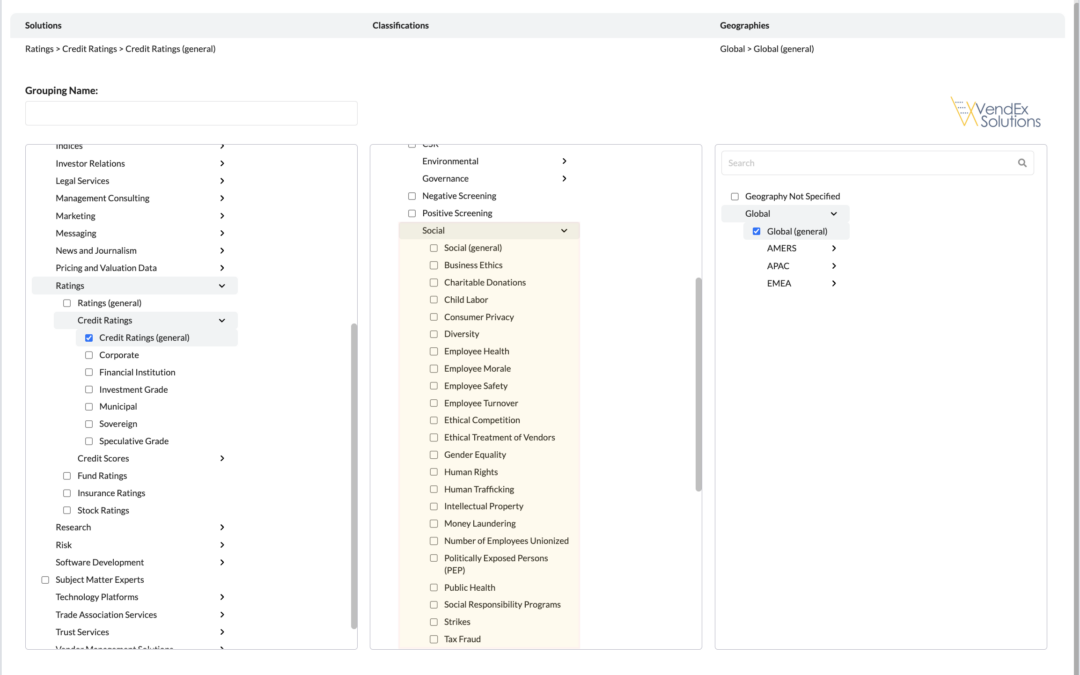

Richard Clements has a talent for explaining highly technical concepts in ways that make them sound as easy as listening to your favourite song. Which is apt, considering that the chief executive of VendEx, a vendor and data cataloguing technology provider, explains...